Your 2023 Tax Documents Center

Find valuable information about your tax documents on where to access, how to print, and when you’ll receive them at our Tax Documents Center.

Frequently Asked Questions

When is the deadline for filing taxes?

The deadline for most taxpayers to file a federal tax return is Monday, April 15, 2024. Filing a tax return extension gives you an additional six months (til October 15, 2024) to submit a complete return.

When will I receive my Year-End Tax Documents?

Your 2023 tax documents will be available online on January 24, 2024. If you’re not enrolled in eStatements, then you’ll receive your tax documents in the mail within 5 – 7 business days from January 24, 2024.

How do I access my Year-End Tax Documents online?

Online Banking:

- Sign in to Online Banking.

- Select “Statements” from the left side menu of your accounts page.

- Select the “View Statements” tab and click the “View” button.

- Scroll down to the bottom of the page to the eTax Form section.

Mobile Banking:

- Sign in to the Mobile Banking app.

- Select “Statements” from the bottom menu.

- Select the “View Statements” tab and click the “View” button.

- Scroll down to the bottom of the page to the eTax Form section.

How do I download and print my tax documents?

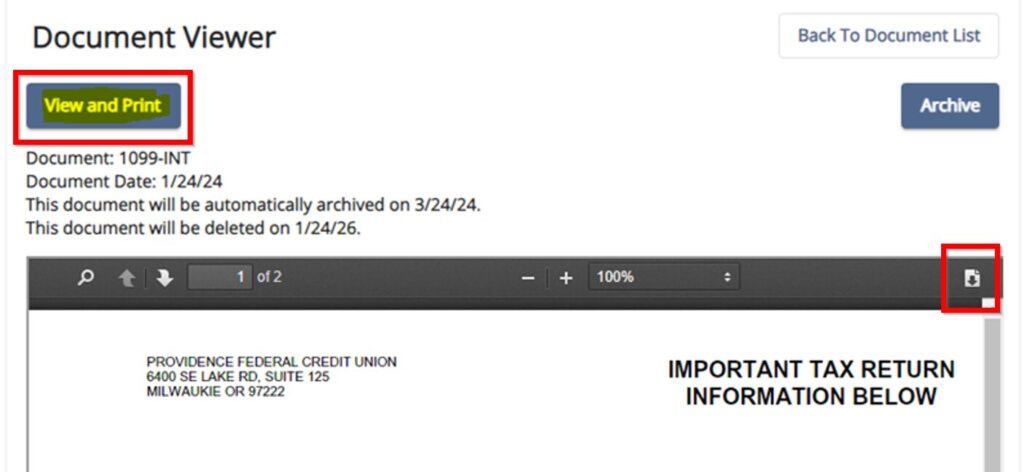

Click the “View and Print” button to see your statement and download to print. You can also simply download by clicking the icon located at the top right of the statements.

Why haven’t I received my 1099-INT yet?

If you did not receive at least $10 in dividends in the prior year, you will not receive a 1099-INT from us.

Where can I find how much interest I have earned in 2023?

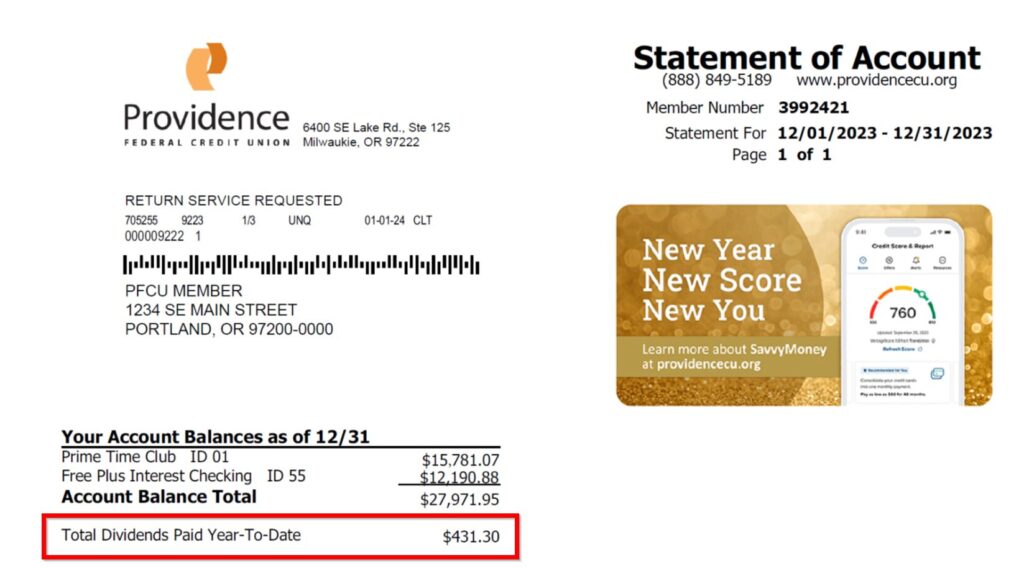

You can find your “Total Dividends Paid Year-To-Date” on your year-end monthly statement (12/31/2023).

2023 Tax Forms You May Receive

1099-INT Form

If you received $10 or more in dividends in the prior year, your Form 1099-INT is available for download within Online or Mobile Banking. Click here to learn how to access your tax documents.

If you didn’t sign up for estatements, you’ll receive your 1099-INT in the mail within 5 – 7 business days from January 24, 2024.

1098 Mortgage Interest Statement Form

If you have a mortgage loan with us, and paid $600 or more in interest in the prior year, your Form 1098 Mortgage Interest Statement is available within Online or Mobile Banking. Click here to learn how to access your tax documents.

If you didn’t sign up for estatements, you’ll receive your 1098 Mortgage Interest Statement in the mail within 5 – 7 business days from January 24, 2024.

1098-E Student Loan Interest Statement Form

If you have a student loan with us, and paid $600 or more in interest in the prior year, your Form 1098-E Student Loan Interest Statement is available within Online or Mobile Banking. Click here to learn how to access your tax documents.

If you didn’t sign up for estatements, you’ll receive your 1098-E Student Loan Interest Statement in the mail within 5 – 7 business days from January 24, 2024.

To enroll in Free eStatements

Ready to go paperless? We make it easy!

Online Banking:

- Sign in to Online Banking.

- Select “Statements” from the left side menu of your accounts page.

- Select the “Manage Preferences” tab.

- Under “Go Paperless?”, toggle the button.

- Read the terms and click “I accept the Terms & Conditions” button.

- Now you’ll see the “Delivery: Mailed” has been changed to “Delivery: Emailed”.

Mobile Banking:

- Sign in to Mobile Banking.

- Select “Statements” from the bottom menu.

- Select the “Manage Preferences” tab.

- Under “Go Paperless?”, toggle the button.

- Read the terms and click “I accept the Terms & Conditions” button.

- Now you’ll see the “Delivery: Mailed” has been changed to “Delivery: Emailed”.

If you have trouble accessing your tax documents, please contact us or call (888) 849-5189 for assistance.